Death of Oil?

- Ken - Chief Rubbernecker

- Apr 5, 2020

- 8 min read

Updated: Apr 7, 2020

"Energy forecasting is easy. It's getting it right that's difficult." -- Graham Stein April 5, 2020

One of my first jobs after grad school was as an equity analyst at a mutual fund company. There were a few of us analysts there, so we divvied up research responsibilities. The guy who knew how to log into AOL became the technology analyst. The guy who owned a miter saw covered industrials. I knew how to fill my gas tank and pay someone to check my oil, so I became the energy analyst. This was back in 1996. Stocks were in a bull market that was just starting to accelerate. Oil…well, look at the chart below. Oil had basically been dead for 26 years and was also starting to accelerate…lower. This is not the kind of industry a budding analyst would normally be excited to cover, but I threw myself into learning the ins-and-outs of oil and gas producers, energy service companies, refiners, and the history of the oil industry and OPEC. Within a year, I felt confident that there weren’t many investors in the country who understood the industry better than I did. Granted, there weren’t many around who cared. Most of the “old-timers” had been burned by oil investing, watched it fall for 26 years, and were in a 12-step recovery program to deal with their trauma.

Fortunately, I was an undamaged fledgling. Within a year, my research led me to the conclusion that the oil market was much tighter than believed and prices would be headed much higher reasonably soon. There were a dozen other potential catalysts, but no one wanted to listen. I took what money I had, maxed out cash advances on a half dozen credit cards, borrowed more on margin, put all that money in a few of my favorite energy service stocks, soiled myself every day for a few months, and ultimately enjoyed my first huge investing win.

It’s Been A Whoil

Oil is going to remain critical for the functioning and growth of the world economy for decades to come. Despite the strong support and development of renewables, oil demand has continued to churn higher in recent years and recently stood at about 100 million barrels per day. That’s a lot of oil. Nevertheless, we haven’t been active buyers in the space for nearly a decade. The equities haven’t been compelling, and one of the key reasons has been the growth of shale oil drilling.

To keep things simple, the “normal” way oil is extracted is by drilling a hole straight down to a pool of oil. Shale oil is unconventional. The drilling starts vertically but eventually turns horizontal, drilling straight into a bed of shale rock that contains oil. Oil doesn’t flow easily in shale, so the drillers perforate the rock with small explosives and force a combination of water, sand, and chemicals into the well to frac, or fracture, the rock. This allows the oil to move more freely into the well bore and to the surface.

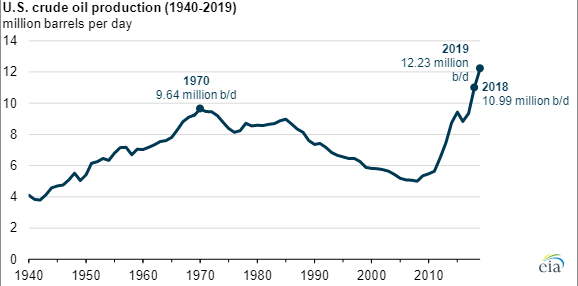

The impact of shale oil has been impressive, as shown in the first chart below. U.S. production had been falling steadily for 30 years until the advent of horizontal drilling and fracking, after which crude production quickly soared to record highs. The second chart shows why this was important, as fewer of those “normal” wells were being discovered. To replace the 36 billion barrels of oil we use each year, we need to find a lot of oil…36 billion barrels of it.

Shale seems like a heroic story so far. Prince Shale rides in on its stallion, kisses the withering oil industry which springs back to life, and everyone lives happily ever after. Unfortunately, this prince never took a basic budgeting course and is living hand-to-mouth and struggling under a barrel of debt. It turns out, these shale wells deplete much faster than first thought. It isn’t abnormal for 50-70% of a shale well to be produced in the first year, followed by a rapid drop-off. All but the best wells lose money unless oil prices are sky high. These companies are destroyers of capital.

Well, it’s payback time for the shale drillers. The agreement that OPEC had with Russia recently imploded, and the Saudis have decided it’s a fine time to flex their muscles and flood the market with oil, at least for now. In addition, the current global recession has destroyed oil demand, no surprise given how much of the world is under lockdown. The combination of the two has collapsed oil prices from $60 at the start of the year to the $20-30 range recently. Reasonable estimates put excess daily supply at 15-30 million barrels per day. This extra supply is flowing into storage, effectively putting a cap on oil prices. The shale industry is a dead man walking.

The final nail in the coffin for shale is the return of rational capital allocation. For years, the Fed’s monetary policies have encouraged massive misallocations of capital. Investors have been happy to throw cash at money-losing tech startups, money-losing direct-to-consumer firms, money-losing Elon Musk businesses, and pretty much anyone with respectable story-telling skills…and an unprofitable business. You’ll be hard-pressed to find a better storyteller than a seasoned oilman with an unprofitable well.

Investors didn’t care about profitability because…well…prices just go up! It’s looking more and more like those days are over. Going forward, businesses will need to show a fairly rapid and achievable path to profitability if they want to raise equity. Shale doesn’t work in a rational world with low oil prices. These companies can’t fund themselves internally, and few will be attracting external capital any time soon. Doors will be closed, lights will be turned off, and wells will be shut in (turned off). Shale oil growth had already declined in 2019, well before the coronavirus surfaced. We’re going to see it drop preciptously and turn negative in the years ahead.

Crisis Creates Opportunity

With most commodities, the cure for low prices is low prices. Oil is no different. Low prices cause producers to eventually shut-in production and cease new drilling. Funds for exploration and development shrink. The shale companies are going to get hit the hardest because they need some of the highest oil prices to justify their existence, but even the majors (Exxon, BP, Chevron, etc.) have begun announcing cutbacks in their spending plans. All of these moves will take a while to play out, but we’re going to see supply getting whacked until it balances out with demand again. The Saudis may be sending the world a message with their recent move to oversupply the market, but the reality is that they ultimately need much higher oil prices. They’re likely hoping to drive marginal players (like shale) out of the market while playing hardball with the Russians, but they risk internal unrest if they don’t keep the money flowing.

Oil at $20-30 is already discounting a lot of bad news, but with inventory continuing to build and storage likely to fill globally, there is a very real possibility that oil prices haven’t seen their lows. Regardless, the stage is being gradually set for a huge oil bull market once we bottom. Conventional oil fields are being depleted, there are very few new giant oil fields being found, and shale is about to fall off a cliff. The Saudis like to suggest that they have the ability to significantly ramp their production, but that’s unlikely for any extended period without damaging their wells. At some point, we’re going to see oil north of $100 again. The issue, as always, is timing.

The mainstream view is that oil stocks are dead for a long time, if not permanently. Investors were already casting their votes before the virus hit and OPEC splintered. The next chart shows that energy stocks have been falling steadily as a percent of the S&P 500. Energy stocks accounted for over 25% of the stock market in the early 1980s, 15% at the peak of the last crisis in 2009, and a measly 5% now. I get excited when I find an industry that investors hate, that has been out-of-favor for years, and that has misunderstood or unappreciated catalysts to drive it higher in the years ahead. Oil stocks are ticking the boxes.

The Long And Short Of It

With oil plummeting to $20, we started buying in mid-March. We added positions in British Petroleum, Royal Dutch Shell, and Chevron, three quality names with decent balance sheets that would survive a prolonged downturn. In addition, they offered dividend yields in the mid-teen percent range when we bought, a yield that would still be solid if they had to cut the dividend in half to preserve capital. Our plan was to gradually add to these and others as the price of oil declined and share prices dropped.

Last week, however, Trump announced that he was talking to the Saudis and Russians about a big cut to production. Oil and oil-related stocks jumped immediately, a bit overexuberantly in my view. If we have excess supply of 20 million barrels per day and OPEC+ agree to cut production 10 million barrels/day, it just takes a little bit longer to fill storage globally. Once filled, what is the value of any new produced oil if there’s no place to put it? We took the gift of Trump’s tweet and sold our three new names, booking gains of 35-65% in two short weeks. If we do see a move back to and through the lows, I’ll be happy to rebuild those positions and add more the uglier things get. This is why we have cash.

We may have sold our oil producers last week, but we were adding to our oil tanker positions. I commented in my last piece about how these companies were benefitting from contango (higher oil prices in the future than the present) and were practically printing money. They were hit hard at the end of last week as oil rallied and the contango shrunk. Despite this, the announced day rates on new charters remained near record highs. I expect contango to grow again as the market realizes that there is going to be a big oversupply for a while, even if the Saudis change their tune and cut production. More of these tankers are going to be used for floating storage as land storage fills up, and this will reduce the fleet available for normal transportation needs, keeping those prices elevated. Wall Street and the investment community are going to perk up when they see the cash flow these companies are generating, especially in the current market environment where earnings, let alone earnings growth, is going to be hard to find anywhere.

Aside from the oil space, we once again added to a different part of the energy complex last week - our uranium names. Unlike oil, the inventory and supply/demand situation with uranium is very bullish. Nuclear power plants don’t shut down when the economy slows. This is base line power that is running over 95% of the time. We’ve been patiently building this position for a while, waiting for the inevitable return of electric utility buyers. We’re close.

Despite my concerns about the stock market overall, I continue to find pockets of incredible value. I’ll keep focusing my own energy on our best ideas.

Best,

Ken Bell, CFA, CFP, MBA, Energy Opportunist

Aspera Financial, LLC

The Market Rubbernecker is associated with Aspera Financial, LLC, an investment management and financial planning firm based in the Cary, Raleigh, and Durham area of North Carolina. This and all Market Rubbernecker missives and musings (written, oral, or mimed) are subject to the disclaimers, disavowals, and hindquarter-coverings found at www.asperafinancial.com/aboutrubbernecker.

Comments